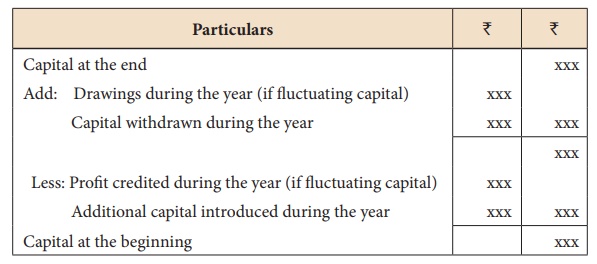

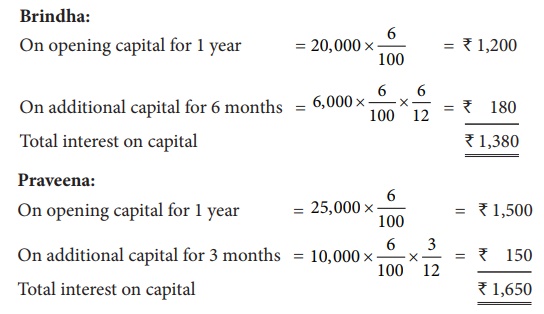

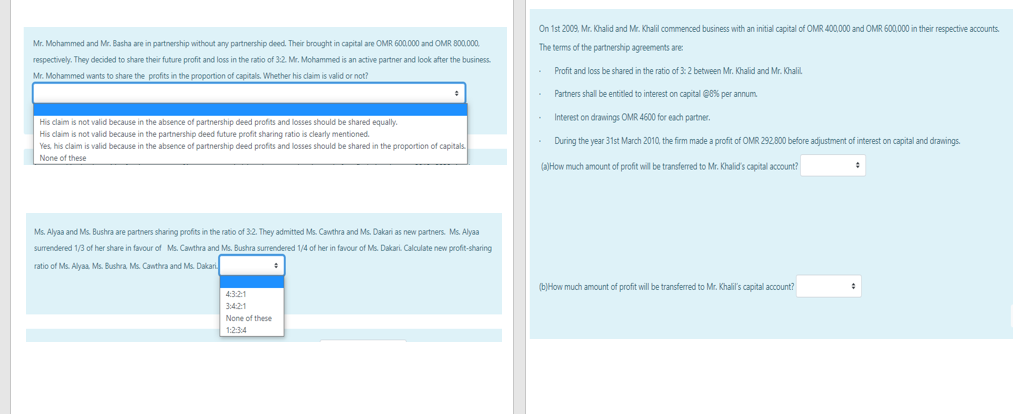

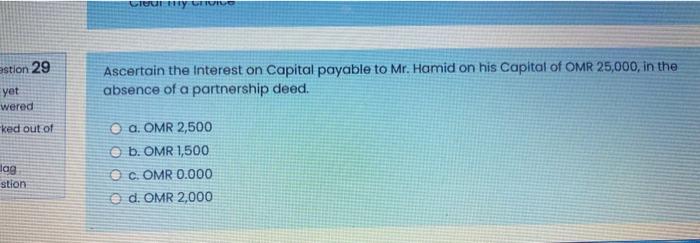

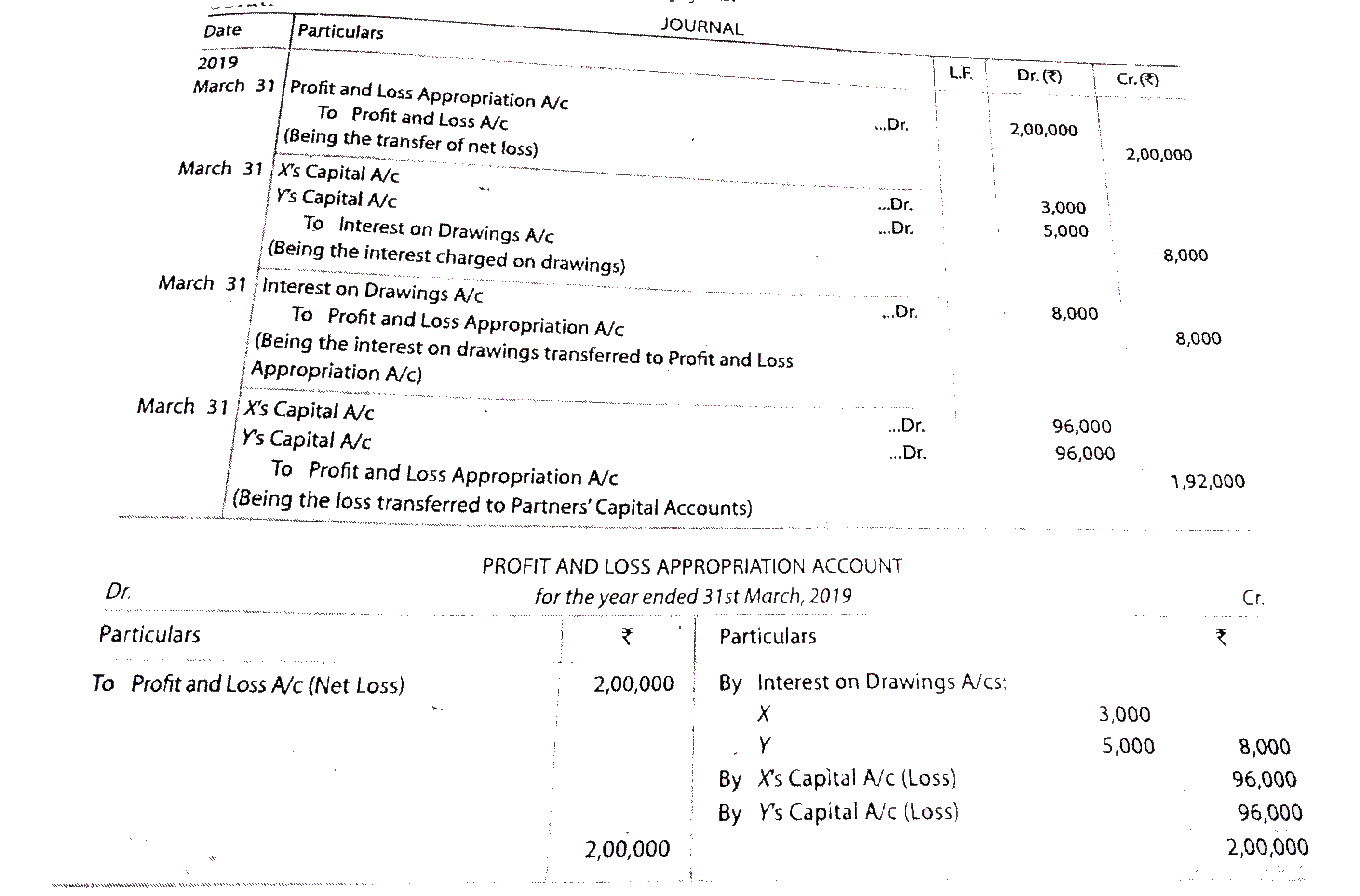

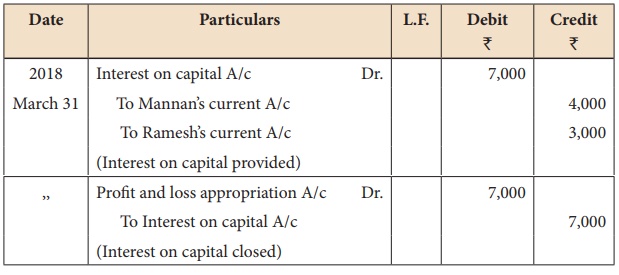

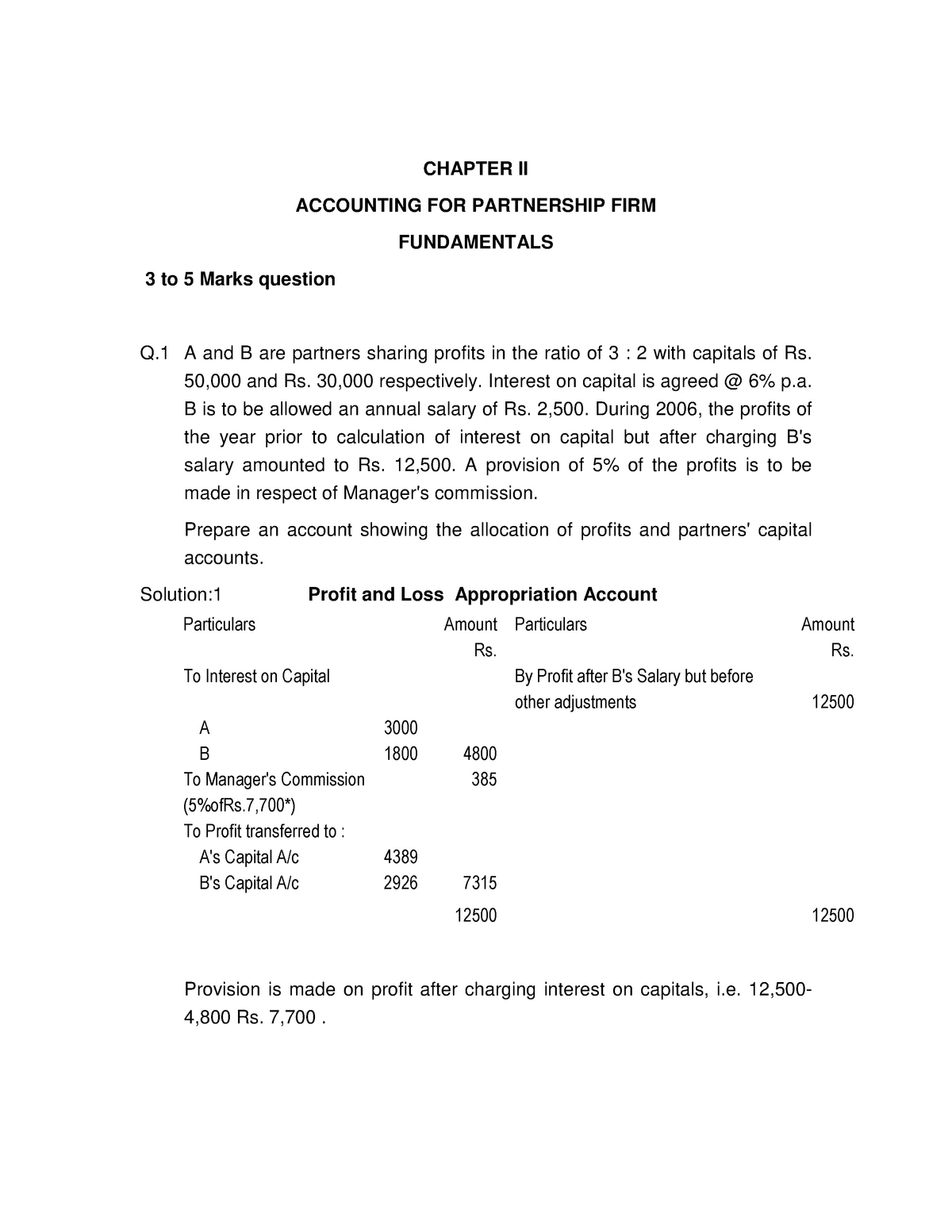

Partner's Capital INTEREST ON CAPITAL Interest on partners capital will be allowed only when it has been specifically mentioned in the partnership deed If interest on capital is to be allowed as per the agreement, it should be calculated with respect to the time, rate of interest and the amount of capital A partnership firm earned divisible profit of Rs 5,00,000, interest on capital is to be provided to partner is Rs 3,00,000, interest on loan taken from partner is Rs 50,000 and profit sharing ratio of partners is 53 sequence the following in correct way Their fixed capitals were A ₹ 9,00,000 and B ₹ 4,00,000 The partnership deed provided the following (i) Interest on capital @ 10% pa (ii) A's salary ₹ 50,000 per year and B's salary ₹ 3,000 per month Profit for the year ended 31st March 19 ₹ 2,78,000 was distributed without providing for interest on capital and partner's

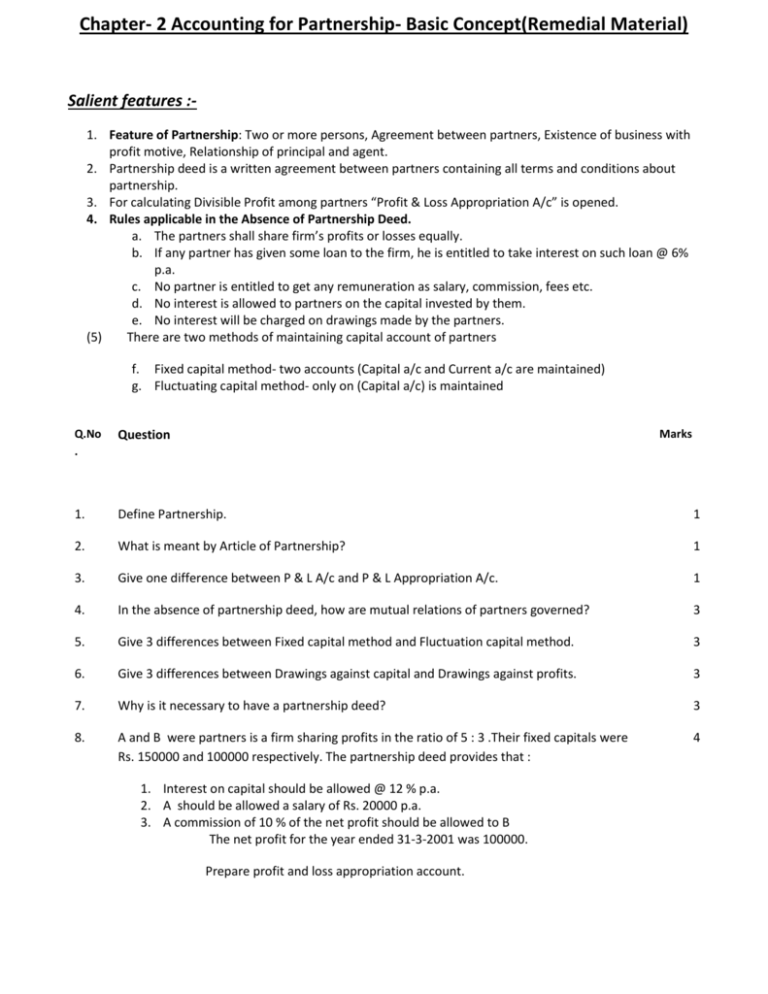

2 Accountancy Chapter 2 Accounting For Partnership Basic Concepts

In absence of partnership deed interest on capital is

In absence of partnership deed interest on capital is-On 1st June, 18 a partner introduced in the firm additional capital Rs 50,000 In the absence of partnership deed, on 31st March, 19 he will receive interest A 25 Interest on partner's drawings under Fluctuating Capital Accounts is debited to (A) Partner's capital Accounts (B) Profit and loss accounts Drawings Accounts (D) None of these Answer Partner's capital Accounts 26 Partnership Deed is also called (A) Prospectus (B) Articles of Association Principles of Partnership

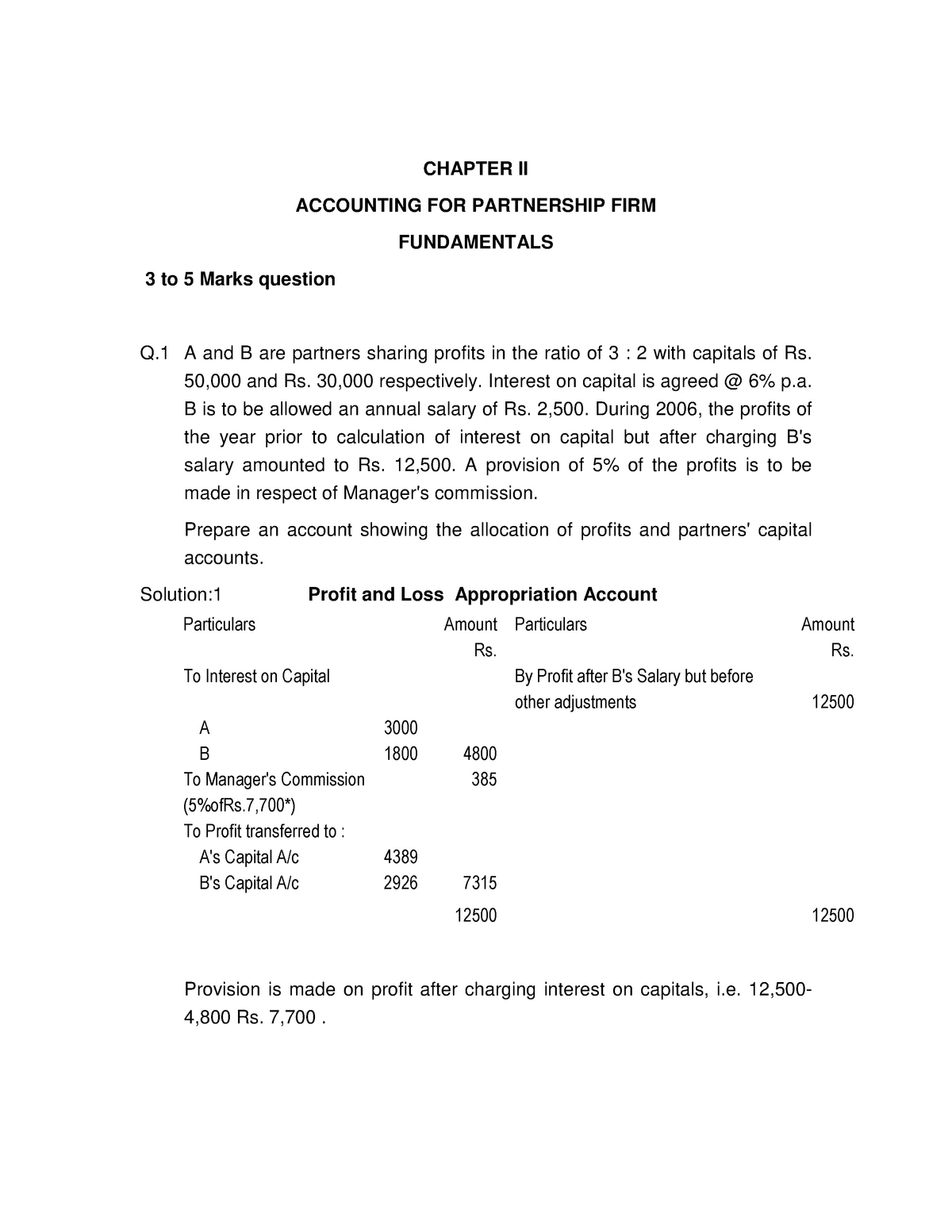

Partnership Accounting Sample Questions Iba Studocu

In absence of partnership deed (a) interest on capital is given (b) interest on drawings salary is given (d) provided share in profitsQ2 Interest on Partner's drawings will be debited to Q3 The interest on partner's drawings is debited to (iv) P & L App A/c Free PDF Download of CBSE Accountancy Multiple Choice Questions for Class 12 with Answers Chapter 1 Accounting for Partnership Firms — Fundamentals Accountancy MCQs for Class 12 Chapter Wise with Answers PDF Download was Prepared Based on Latest Exam Pattern Students can solve NCERT Class 12 Accountancy Accounting for Partnership Firms —

MCQ Questions for Class 12 Accountancy with Answers Q1 In the absence of partnership deed how much interest will be given on capital?How do you Treat in the absence of partnership Deedsharing profit, interest on drawing, capital, salary to partnerand loan from partner in explanation in (A) when there is no partnership deed (B) where there is a partnership deed but there are differences of opinion between the partners when capital contribution by the partners varies (D) when the partner's salary and interest on capital are not incorporated in the partnership deed Answer Answer A 18 In the absence of Partnership Deed

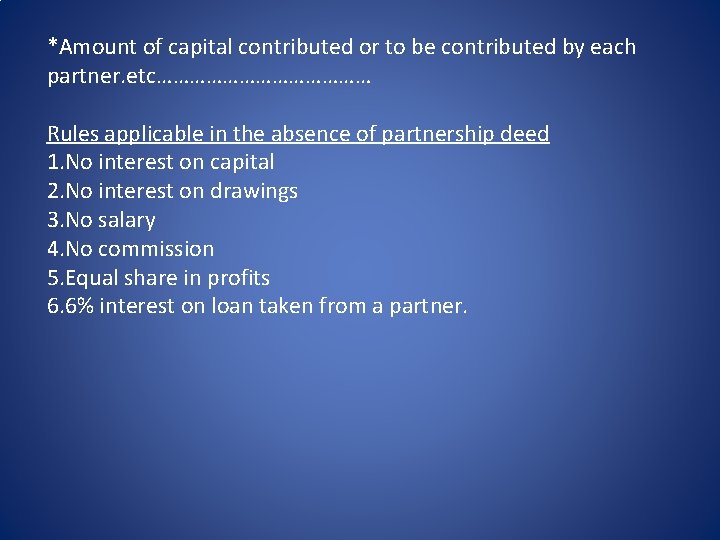

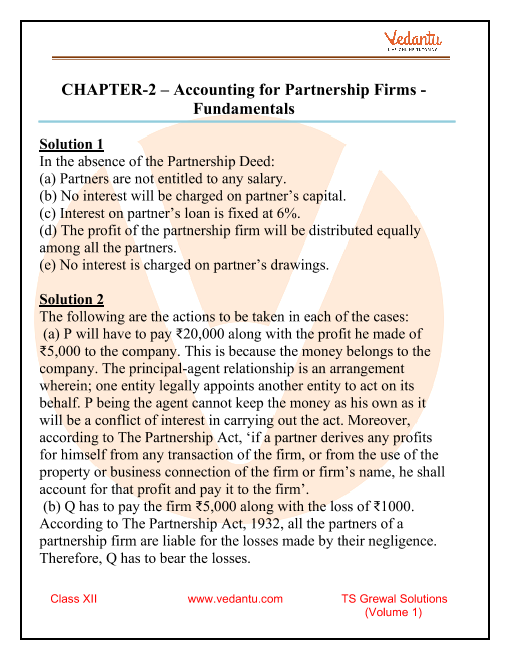

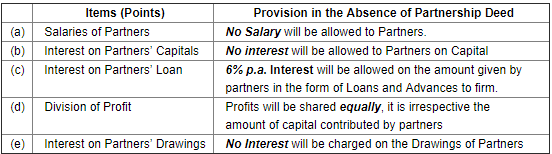

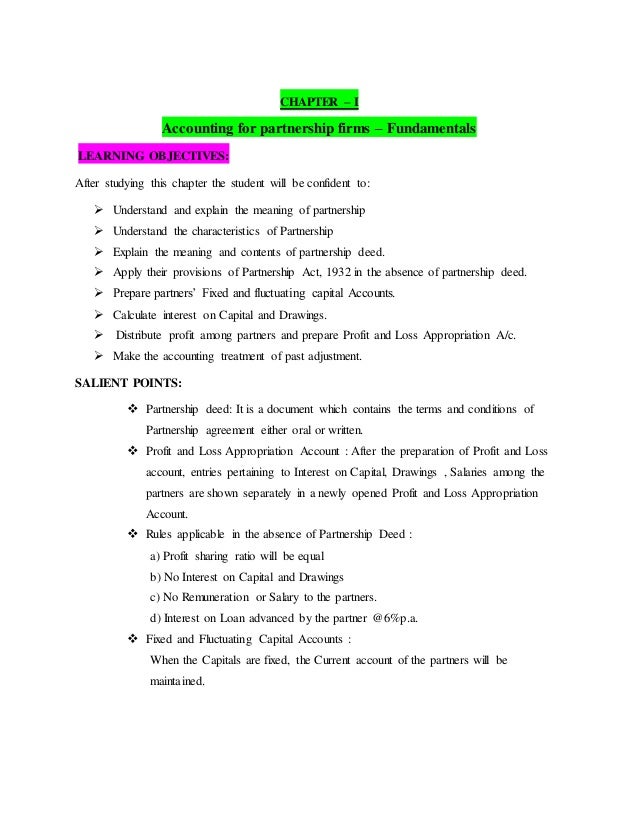

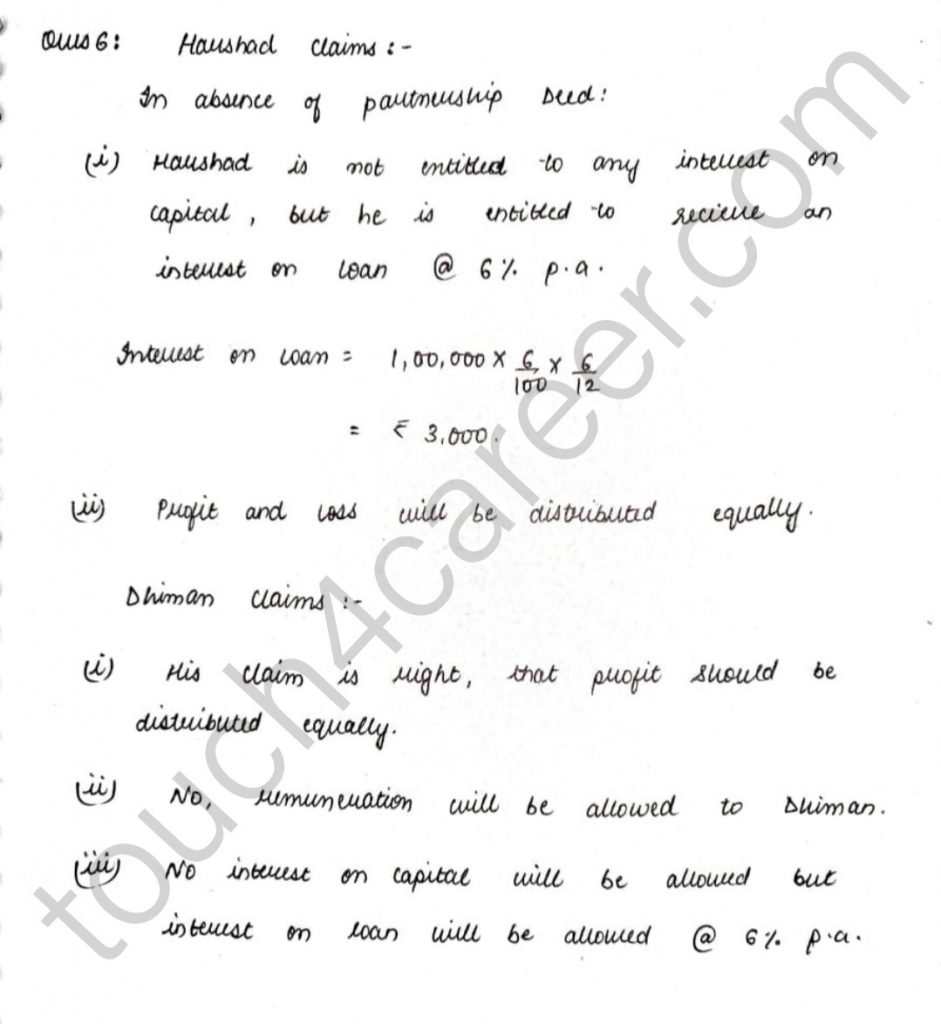

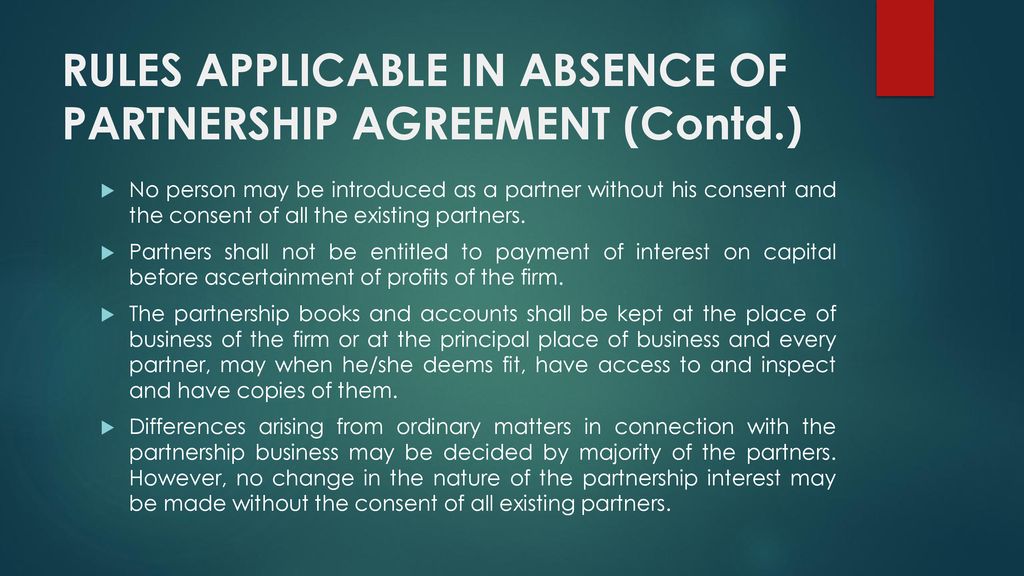

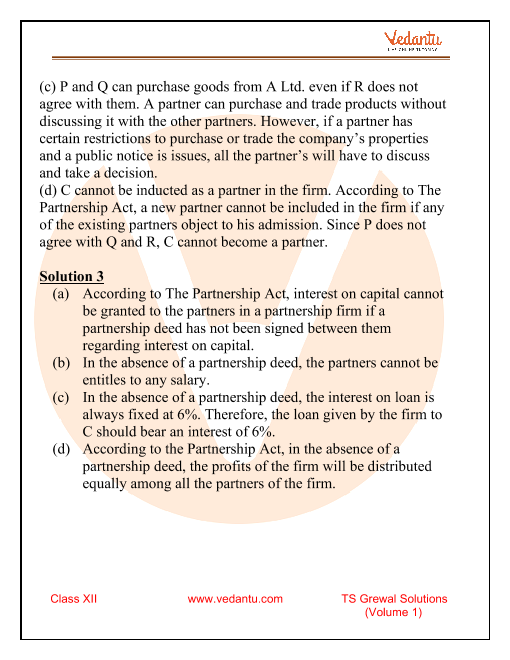

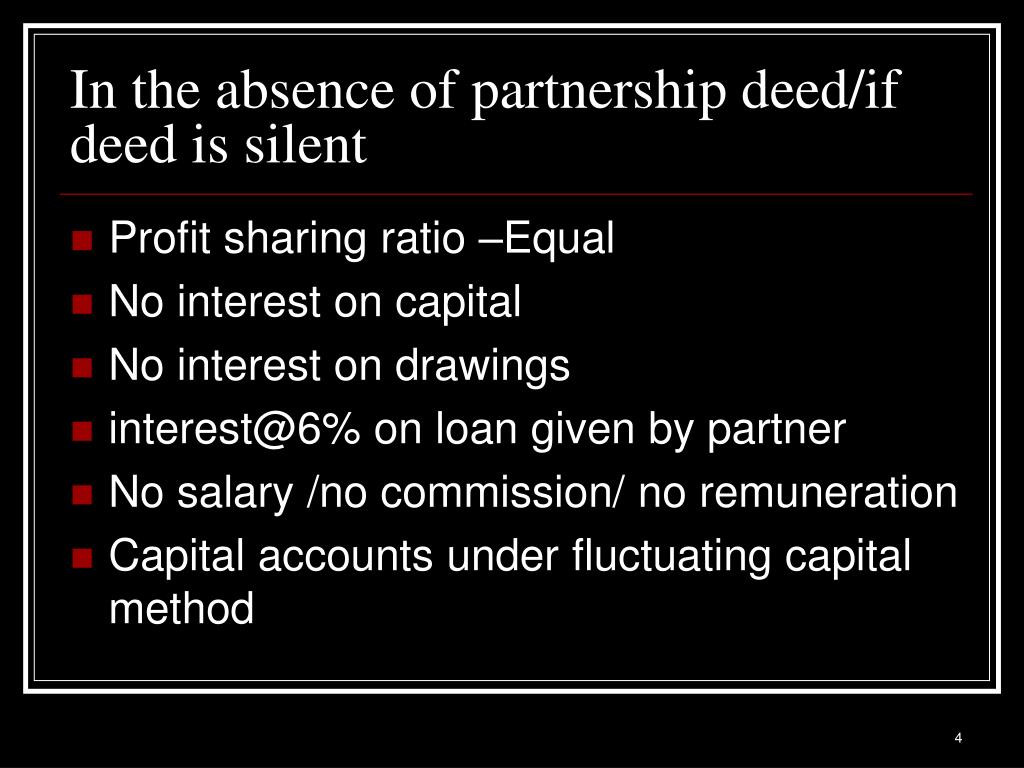

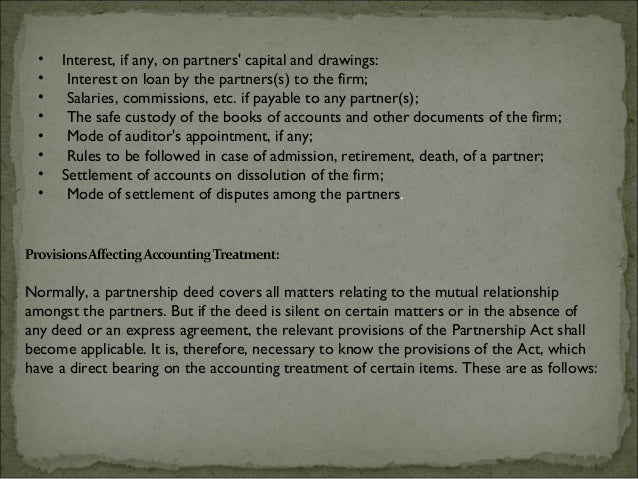

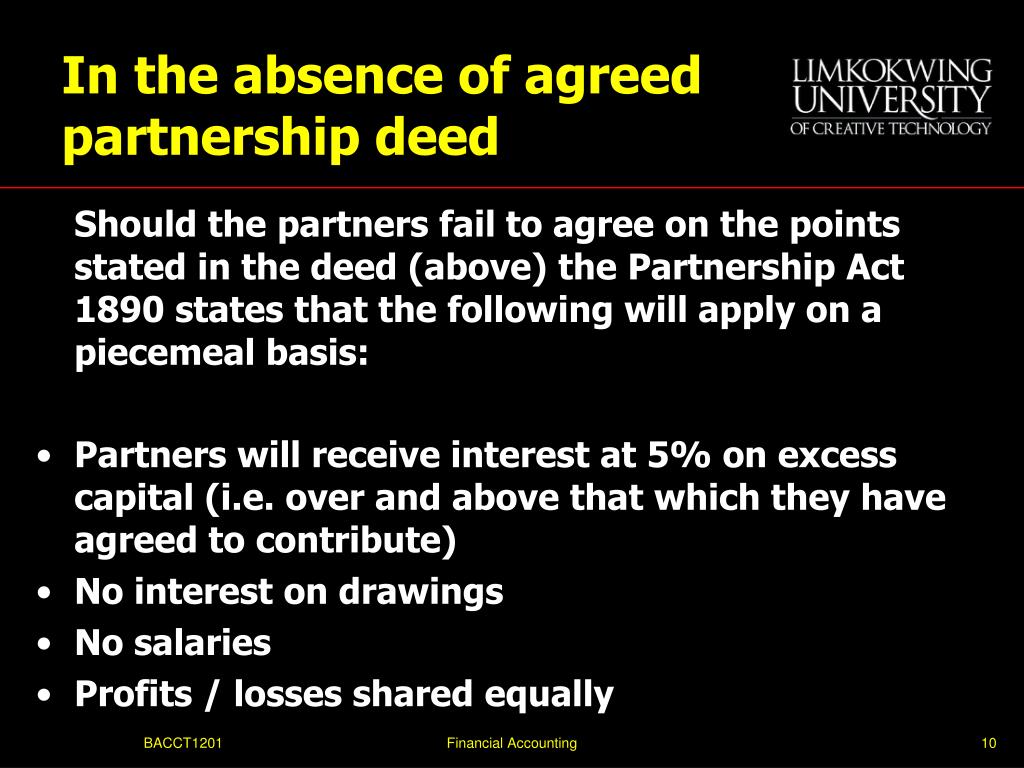

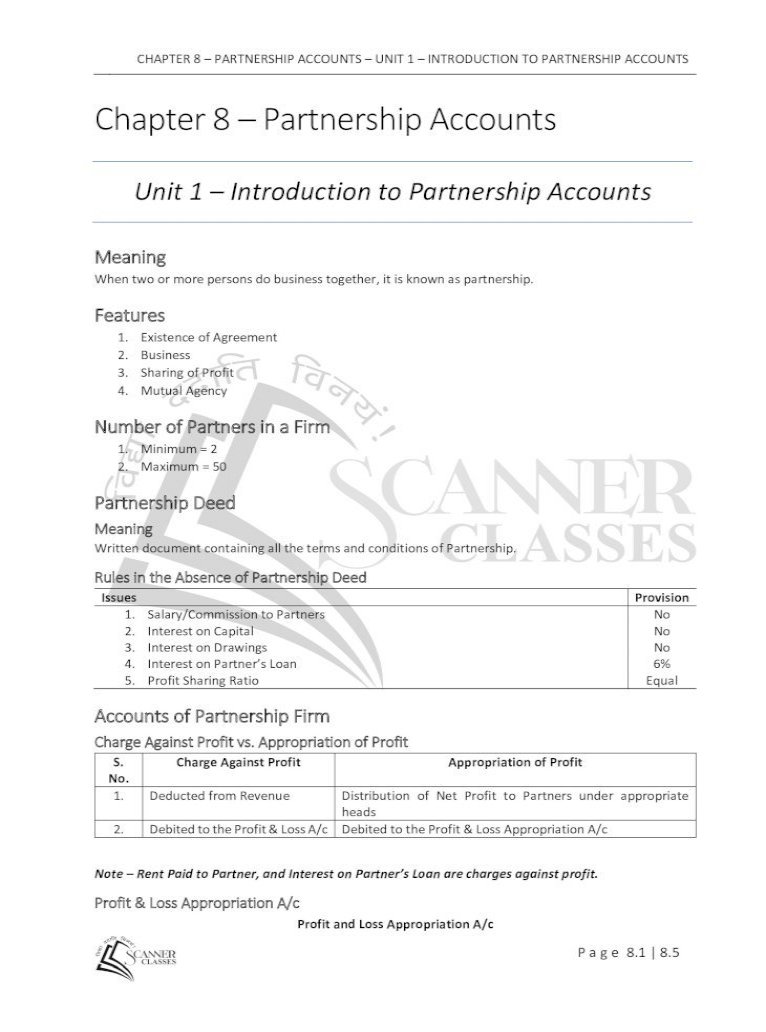

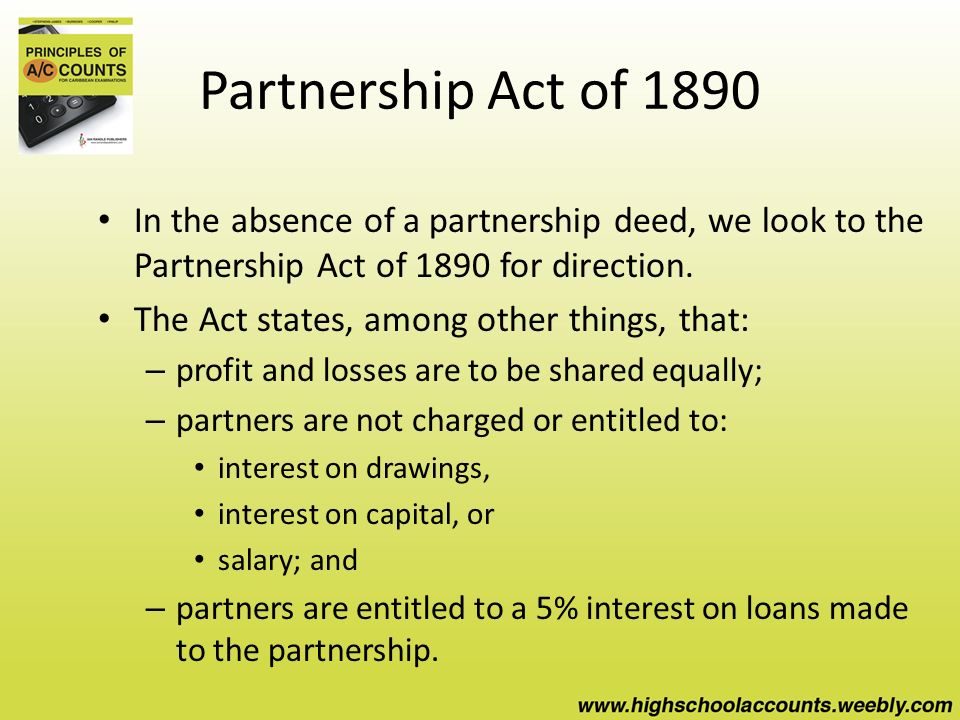

(i) Interest on Partner's Drawings In the absence of Partnership Deed there is no provision to provide Interest on Partner's Drawings in Partnership Act, 1932 (ii) Interest on Advances other than capital Advance other than capital are treated as Loan to the firmIn the absence of Partnership deed, according to Partnership Act of 1932, the partners are entitled for 6% pa interest Partnership Deed is the written agreement between the partners, which is duly signed and registered under the Act and contains all the terms and conditions which govern the operation of the activities of the partnership firm Since partnership results out of an agreement, it is essential that there must be some terms and conditions agreed upon by all the partnersIn the absence of a partnership deed and where there is no indication as to the agreement between the partners in this aspect, it should be considered as equal share for all partners The ratio may be specified in terms of absolute values or it may be expressed as the ratio of their Capital account balances or it may be based on anything else as agreed upon by the partners

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Solution 18 Partnership General 163 Kb Studypool

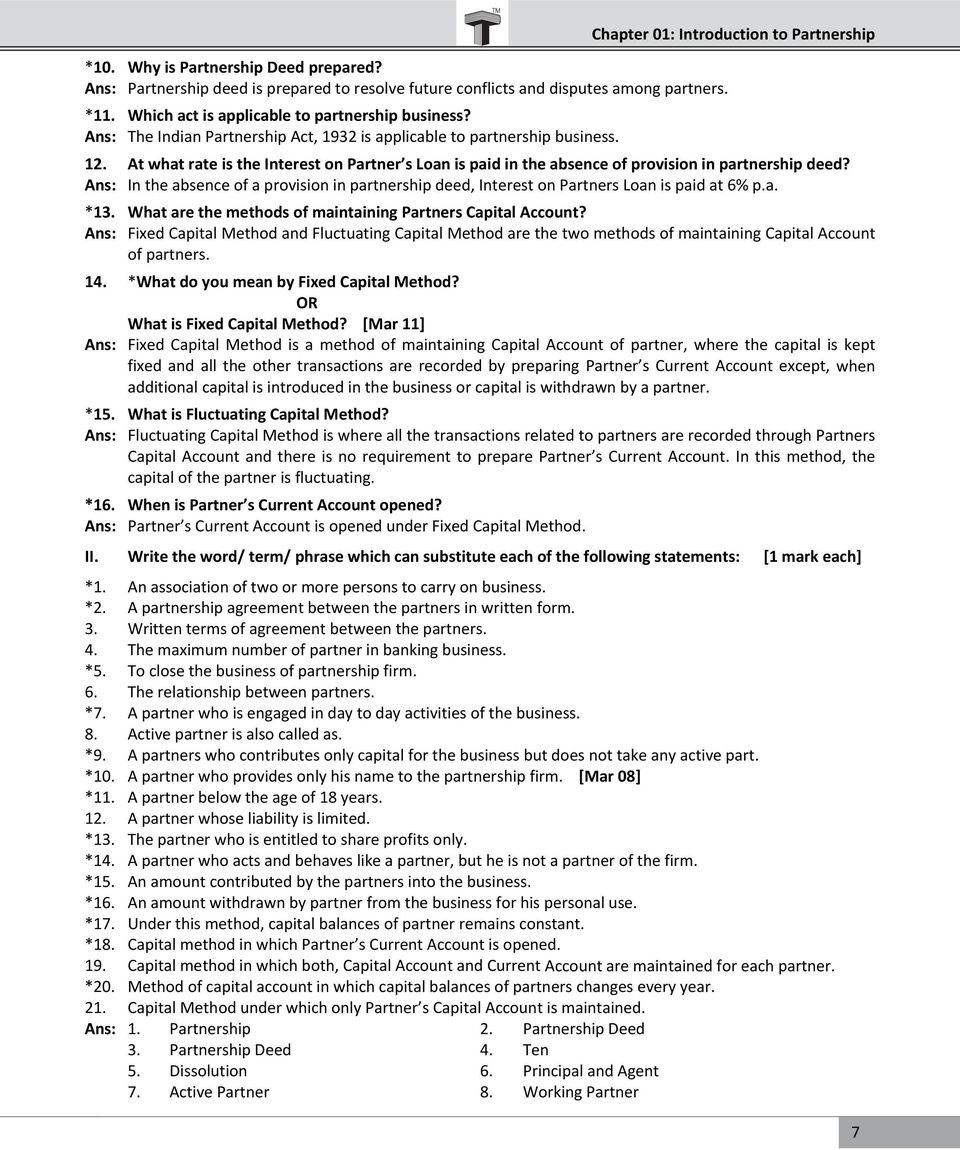

In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner The partnership deed provided the following (CBSE Compt 19) (i) Interest on capital @ 10% pa (ii) A's salary ₹ 50,000 per year and B's salary ₹ 3,000 per month Profit for the year ended 31st March 19 ₹ 2,78,000 was distributed without providing for interest on capital and partner's salaryInterest on Partners' Capitals No interest will be allowed to Partners on Capital (c) Interest on loan by partner As per Indian Partnership Act, 1932, 6% pa Interest will be allowed on the loan amount of partners (d) Division of Profit In the absence of partnership deed profit is distributed equally (e) Interest on Partners' Drawings

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts Www Cbsetuts Accounting Solutions Fundamental

Unit 1 Accounting For Partnership Firms Marks 35 Dissolution Of A Partnership Firm Types Of Dissolution Pdf Document

No interest is allowed on the capital Where a partner is entitled to interest on capital contributed as per partnership deed, such interest on capital will be payable only out of profits Section 13(c) (iv) Interest on loans advanced by partners to the firm Interest on loan is to be allowed at the rate of 6 per cent per annum Section 13(dInterest on capital Interest on capital is the interest allowed on capital of the partners In general, if the capitals of partners are disproportionate to the profit sharing ratio the partners may agree to allow interest on capital It will compensate the partners who have contributed high amount towards capitals In the absence of partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, the following provisions of the Indian Partnership Act, 1932 will be applicable PROFIT SHARING RATIO Profits and losses are to be shared equally irrespective of their capital contribution INTEREST ON CAPITAL No interest on capital

Accountancy 1 Pages 101 150 Flip Pdf Download Fliphtml5

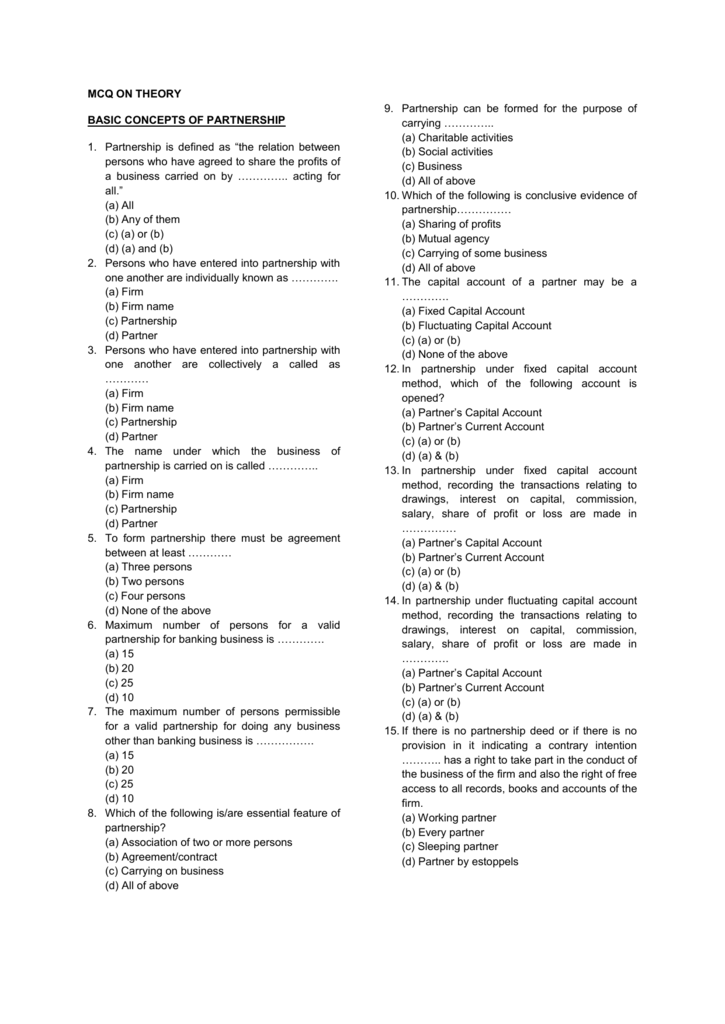

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

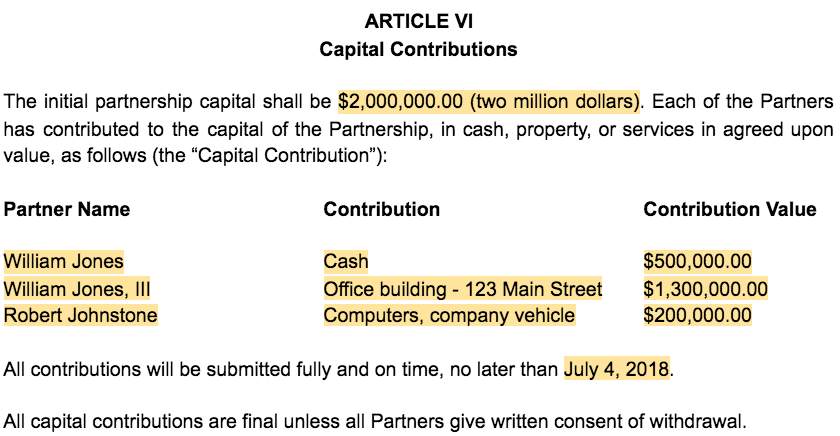

Partnership deed also defines a remuneration or salary of the partners and working partners However, interest is paid to each partner who has invested capital in the business Also Check The importance of the Partnership Agreement The above mentioned concept about Partnership Deed is explained in detail for Class 12 students X, Y, and Z are partners in a firm At the time of division of profit for the year, there was dispute between the partners Profit before interest on partner's capital was ₹6,00,000 and Z demanded minimum profit of ₹5,00,000 as his financial position was not good However, there was no written agreement on this pointIt is not compulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

In The Absence Of Partnership Deed Youtube

(b) Interest on Capital No partner is entitled to claim any interest on the amount of capital contributed by him in the firm as a matter of right However, interest can be allowed when it is expressly agreed to by the partners Thus, no interest on capital is payable if the partnership deed is silent on the issue2 Notes MODULE 4 Partnership Account Accountancy zcalculate interest on capital and interest on drawings; In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner s capital (iii) Interest on Partner s drawings (iv) Interest on Partner s loan (v) Salary to a partner Accountancy Accounting for Partnership

Class 12 Accounts Fundamental Of Accounts Notes

Welcome Chapter1 Accounting For Partnership Basic Concepts Introduction

Absence of a Partnership Deed The partners will share profits and losses equally Partners will not get a salary Interest on capital will not be payable Drawings will not be chargeable with interest Partners will get 6% pa interest on loans toHello Guys ,This video is the third Part of Fundamental Accounting of Partnership and this video includes 1) Rules Applicable in Absence of Partnership DeeZstate the meaning and purpose of Profit and Loss Appropriation account and its preparation;

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Partnership Accounts

RULES APPLICABLE IN THE ABSENCE OF PARTNERSHIP DEED As we know from the previous discusion that it is not cumpulsory to have a partnership deed for a partnership firm Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932In the absence of partnership deed, profits and losses will be distributed equally among the partners Answers 10 – a) Equal Fundamentals of Partnership class 12 MCQ – Explanation 11In the absence of partnership deed, no interest in allowed on capital and no interest (a) Interest on partners capital (b) Interest on partners drawings (c) Interest on partners loan (d) Partners' profit sharing ratio (e) Salaries of partners Answer In the absence of partnership deed the provision affecting of Indian partnership act, 1932 are applicable the important rules are as follows

Partnership Fundamentals Objective Type Mission Accountancy

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

In the Absence of Partnership Deed, Interest on a Loan of a Partner is Allowed (1) at 8% per Annum (2) at 6% per Annum (3) No Interest is Allowed (4) at 12% per Annum Oct 11,21 In the absence of any deed of partnershipa)Only working partners are entitled to Salaryb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Interest at the rate of 6% is to be allowed on a partner's loan to the firmCorrect answer is option 'D' d) When the partner's salary and interest on capital are not incorporated in the partnership deed Ans – a) In the absence of Partnership Deed, the interest is allowed on partner's capital a) @ 5% pa b) @ 6% pa c) @ 12% pa d) No interest is allowed Ans – d) In the absence of a partnership deee, the allowable rate of interest on

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Chapter 2 Distrubution Of Profits Pdf Partnership Interest

Aug 24,21 In the absence of any deed of partnershipa)Interest at the rate of 6% is to be allowed on a partner's loan to the firmb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Only working partners are entitled to SalaryCorrect answer is option 'D'In the absence of Partnership Deed, the interest is allowed on partner's capital A@ 5% pa,B@ 6% pa,C@ 12% pa,DNo interest is allowed In absence of Partnership agreement interest on partner's loan/Advance will be calculated at 6% pa (5% / 6% / 8%) 14 The partner who does not participate actively in partnership business is knows as nominal (nominal / inactive) partner

2 Accountancy Chapter 2 Accounting For Partnership Basic Concepts

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

In the absence of partnership deed, a partner is entitled to an interest on the amount of additional capital advanced by him to the firm at a rate of (A) entitled for 6% pa on their additional capital, only when there are profits (B) entitled for 10% pa on their additional capital entitled for 12% pa on their additional capital Interest on capital No interest is allowed on the capital When a partner is entitled to interest on capital contributed as per partnership deed, such interest on capital will be payable only out of profits Section 13(c) Interest on loans advanced by partners to the firm Interest on the loan is to be allowed at the rate of 6 percent per annumNormally, a partnership deed covers all matters relating to mutual relationship among the partners But, in the absence of agreement, the following provisions of the Indian Partnership Act, 1932 shall apply for accounting purposes 1 Interest on Capital No interest is allowed on Capitals of the Partners If as per the partnership deed

Book Keeping Accountancy Pdf Free Download

Ts Grewal Solutions Class 12 Accountancy Accounting Partnership Firms Fundamentals Accounting Fundamental Solutions

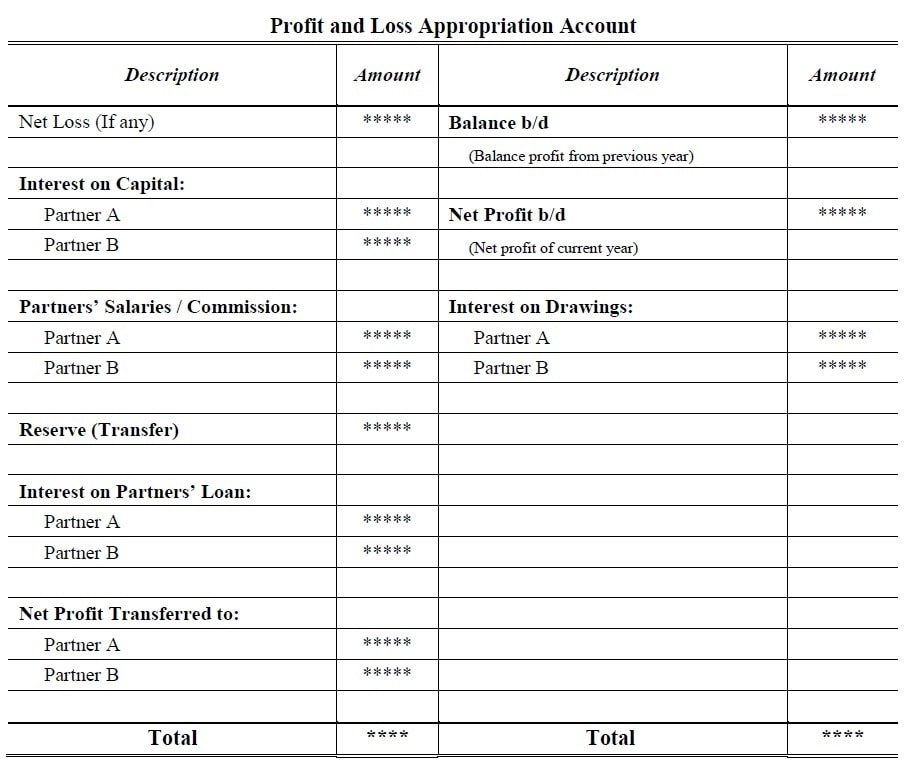

C) RS 19,600 C) RS 19,600 d) RS 18,600 In the absence of partnership deed Interest on capital will be provided @ofZmake adjustment for gaurantee of profit and zmake adjustments for errors made after preparing Balance Sheet 221 PARTNERSHIP AND PARTNERSHIP DEED Total interest on partner's capital is ₹ 3,600 and interest on a partner's loan is ₹ 2,000 Total interest on partner's drawings is ₹ 300, the result of the Profit and Loss Appropriation Account will be (a) ₹ 5,300 Profit (b) ₹ 2,700 Profit (c) ₹ 1,300 Loss (d) ₹ 21,000 Profit 21 In the absence of partnership deed

Doc Chapter 2 Accounting For Partnership Basic Concept Remedial Material Kelvin John Ramos Academia Edu

Fudamentals Of Partnership

In the absence of Partnership Deed, the interest is allowed on partner's capital @ 5% pa, @ 6% pa, @ 12% pa, No interest is allowed Partnership, a partner can transfer his interest in favor of any other partner without the consent of all other partners In absence of partnership deed neither interest is paid on capital nor charged, interest on drawing The liability of each partner in partnershipQuestion X, Y, and Z are partners in a firm At the time of division of profit for the year, there was dispute between the partners Profit before interest on partner's capital was ₹6,000 and Y determined interest @24% pa on his loan of ₹80,000

Gv Commerce Classes Posts Facebook

3

(iv) Interest on Partners Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the partnership deed a partner will be entitled for getting any salary for his work even if the others are non working 21 In the absence of Partnership deed, partners are entitled to interest on capital F 22 Interest on loan advanced by a partner to the firm shall be paid even if there are losses in the business T 23 Under Fixed Capital method, any addition to capital will be shown in Partner's Capital AccountT 24

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

No Partnership Deed Exist Absence Of Partnership Deed Partners A And B Have Contacted You To Solve Brainly In

2jnomj8w4bzlom

On 1st 09 Mr Khalid And Mr Khalil Commenced Chegg Com

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

P 1 Ppt Powerpoint

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Myncert Com

Plus Two Accountancy Part 1 Text Book Pdf Pages 101 150 Flip Pdf Download Fliphtml5

State The Provisions Of Partnership Act 1932 In Absence Of Partnership Deed Regarding 1 Interest On Partners Drawings And 2 Interest On Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Docshare01 Docshare Tips

Ggpsbokaro Org

Question 23 Docx Question 23 In The Absence Of Partnership Deed Interest On Capital Will Be Given To The Partners At B 6 P A D None Of These B Real Course Hero

Capitalcoaching In

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

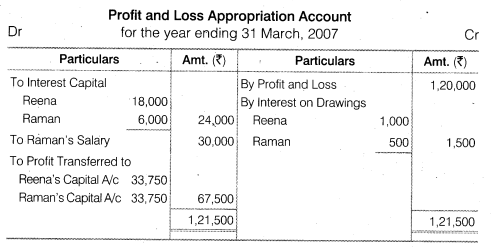

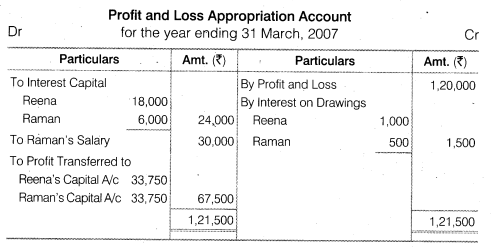

Important Questions For Cbse Class 12 Accountancy Profit And Loss Appropriation Account

Provisions Of Partnership Deed Indian Partnership Act 1932

Solved Paragraph Ram And Shyam Were Partners In A Firm The Partnership Agreement Provides That 1 Profit Sharing Ratio Will Be Quot 3 Il Ra Course Hero

How To Create A Business Partnership Agreement Free Template

Stlawrencehighschool Edu In

Page 30 Debk Vol 1

Fundamentals Of Partnership Mcqs And Answer 12 Cbse Exam 22

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

Solved Luu Givi Estion 29 Yet Wered Ked Out Of Ascertain The Chegg Com

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

X And Y Started Business On 1st April 18 With Capitals Of Rs 5 00 000 Each As Per The Partnership Deed Bth X And Y Are To Get Monthly Salary Of Rs

Create An Amendment To A Partnership Agreement Legal Templates

Department Of Accounting And Finance Course Code Acc Ppt Download

Ts Grewal Solutions Class 12 Accountancy Volume 1 Chapter 2 Accounting For Partnership Firms Fundamentals

Ppt Accounting Finance For Bankers Jaiib Module D Presentation By S D Bargir Joint Director Iibf 22 10 07 Powerpoint Presentation Id 146

Profit And Loss Appropriation Account Accountancy Knowledge

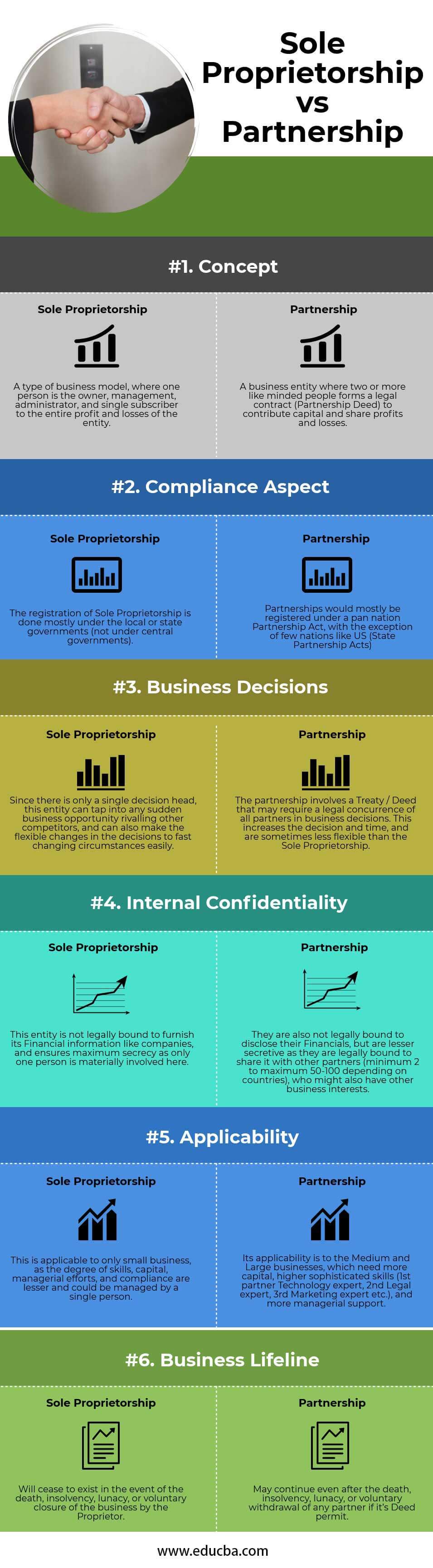

Sole Proprietorship Vs Partnership 6 Best Differences With Infographics

Free Partnership Agreement Create Download And Print Lawdepot Us

1

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

A B C Are Partners In A Firm They Have No Partnership Agreement For Their Guidance At The End Of The First Of The Commencement Of The Firm Sarthaks Econnect

1

Rules Applicable In The Absence Of Partnership Deed Youtube

Icaeizeqdtndnm

Question 04 Chapter 2 Of 2 Part 1 Usha Publication 12 Class Part 1

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Study Materialworkshop 16 Pdf Debits And Credits Goodwill Accounting

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Accounting For Partnership

Partners Loan Account With Interest Thereon Assignment Point

Kendriya Vidyalaya Project Work Chapter 1 Accounting For Partnership Firms Fundamentals Partnership Pdf Document

Q 1 What Are Provision Relating To Governance Of Right To Share

Partnership Accounting

Fundamentals Of Partnership Theory Part 1 By Krishna Flipsnack

16 Pavan Prince And Roy Were Partners In A Firm Sharing Profits In 2 2 1

Accountancy Ch 2 Rules Applicable In The Absence Of Partnership Deed Youtube

Partnership Accounting Sample Questions Iba Studocu

Apsahmednagar Com

Partnership Deed Meaning Format Registration Stamp Duty

Question 1 Not Yet Answered Marked Out Of 1 P Flag Chegg Com

All You Need To Know About The Indian Partnership Act 1932

Freehomedelivery Net

Punainternationalschool Com

In The Name Of God

In The Absence Of An Agreement To The Contrary The Partners

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Accountancy

Page 17 Ma 12

1

Class 12 Accounts Fundamental Of Accounts Notes

Class 12 Accountancy Part 19 Youtube

Free Partnership Agreement Template Create A Partnership Agreement

Ppt Learning Objectives Powerpoint Presentation Free Download Id

How To Create A Business Partnership Agreement Free Template

Cyd Tutorials Sarika Coaching Center Learn And Grow Facebook

Sgs 4 Partnership Agreements Business Law Lpc7302 u Studocu

Interest Remuneration To Partners Section 40 B

Chapter 8 A Partnership Accounts A Unit 1 A Introduction Chapter 8 A Partnership Accounts Unit Pdf Document

2 Mahesh Ramesh And Suresh Are Partners In A Firm They Do Not Have A Partnership Deed At The End Brainly In

Accountancy Practical Oriented Questions Section D 1 Prepare Opening Statement Of Affairs With 5 Imaginary Figures 2 Prepare Capital Accounts Of Two Partners Under Fluctuating Capital System With 5 Imaginary Figures 3

Pdfcoffee Com

Class 12 Accounts Fundamental Of Accounts Notes

Partnership Accounting Ppt Video Online Download

Partnership Firms And Fundamentals Account 12 Cbse Avi Educations

0 件のコメント:

コメントを投稿